Backdoor Roth Ira Going Away 2024

Backdoor Roth Ira Going Away 2024. If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2024 is going to be above the 2024 irs upper income limits. A contribution using this backdoor roth ira strategy.

Is the backdoor roth allowed in 2024? Here’s how those contribution limits stack up for the 2023 and 2024 tax years.

If Your Employer Matched Any Of Your Yearly Contributions, Your Mega.

$7,000 if you're younger than age 50.

Here's What To Check Right Away To Avoid A Surprise And 4 Ways To Reduce Your Taxes As You Withdraw.

The limits are as follows:

$8,000 If You're Age 50 Or Older.

Images References :

Source: personalfinancewellness.com

Source: personalfinancewellness.com

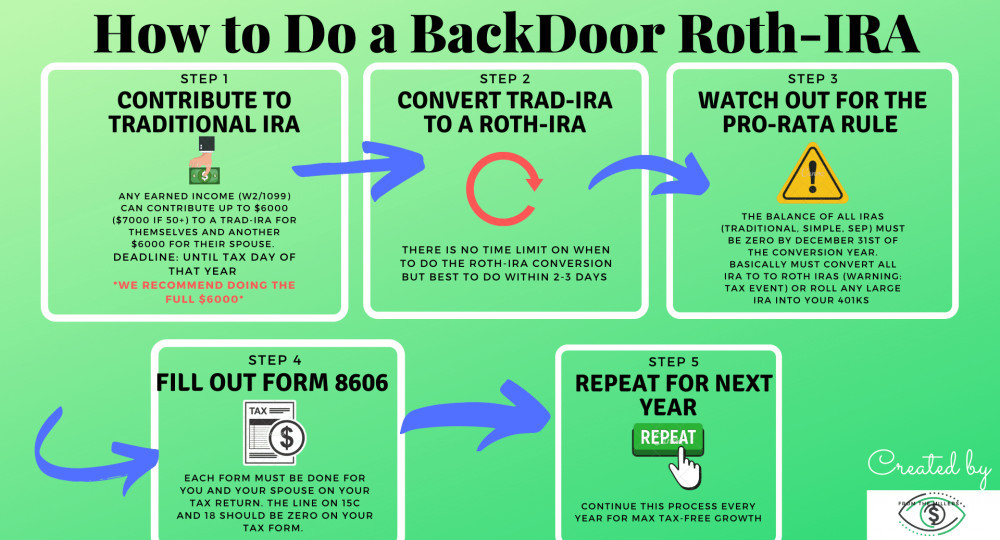

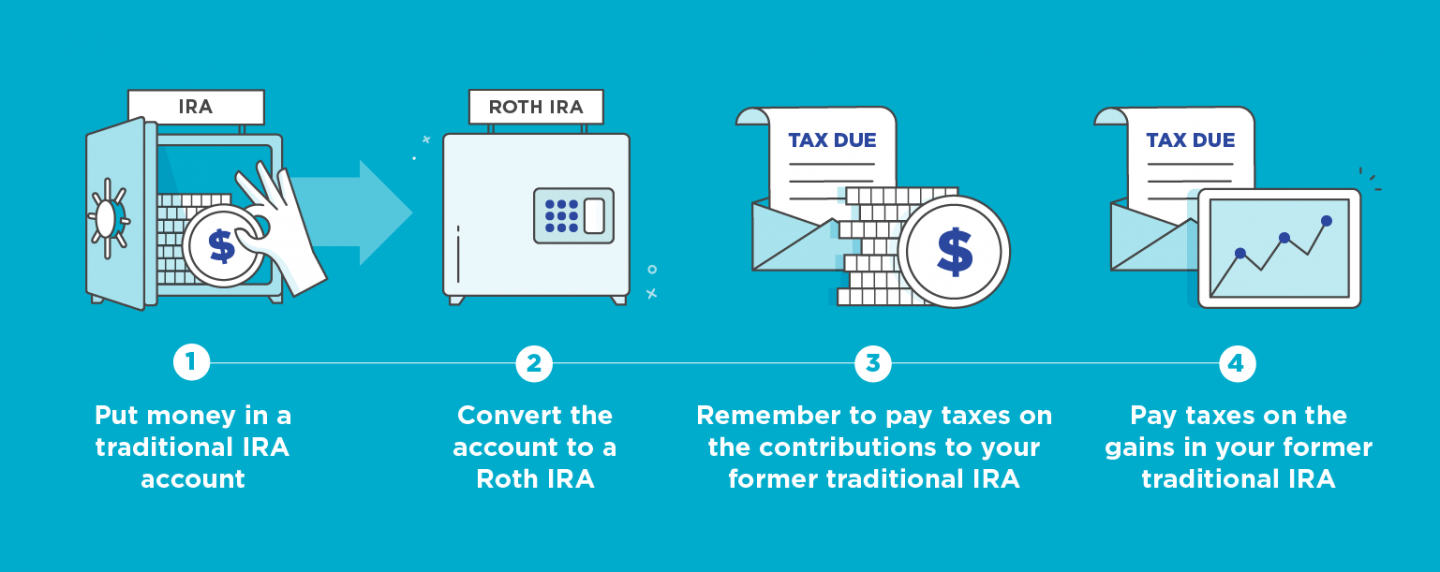

What Is A Backdoor Roth IRA? How Does It Work In 2021? Personal, A backdoor roth ira lets you convert a traditional ira to a roth, even if your income is too high for a roth ira. It’s possible that the law will not change until 1/1/2023.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

How to Set Up a Backdoor Roth IRA NerdWallet, The backdoor roth ira sounds great, but what is it exactly? It’s possible that the law will not change until 1/1/2023.

Source: www.bogleheads.org

Source: www.bogleheads.org

Megabackdoor Roth Bogleheads, A backdoor roth ira lets you convert a traditional ira to a roth, even if your income is too high for a roth ira. $8,000 if you're age 50 or older.

Source: davimanfinancial.com

Source: davimanfinancial.com

A 3Part Guide to the Backdoor Roth IRA Daviman Financial Fiduciary, If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2024 is going to be above the 2024 irs upper income limits. $7,000 if you're younger than age 50.

Source: www.titan.com

Source: www.titan.com

Will the Backdoor Roth Conversion Go Away in 2022? Titan, Is the backdoor roth allowed in 2024? $8,000 if you're age 50 or older.

Source: www.raawealth.com

Source: www.raawealth.com

Is the Backdoor Roth IRA Going Away? Runey & Associates Wealth Management, The maximum contribution limit for roth and traditional iras for 2024 is: If your employer matched any of your yearly contributions, your mega.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Is It Worth Doing A Backdoor Roth IRA? Pros and Cons, While you can only make contributions to a roth ira as long as your income is under a certain amount ($161,000 for single filers in 2024, and $240,000 if you’re. The elimination of the backdoor roth ira would have taken effect after dec.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Limit For Roth Ira Contribution 2021 INCOBEMAN, Here's what to check right away to avoid a surprise and 4 ways to reduce your taxes as you withdraw. The backdoor method allows those with.

Source: inflationprotection.org

Source: inflationprotection.org

How To Do A Backdoor Roth IRA (And Pitfalls To Avoid) Inflation, The limit on ira contributions for 2024 is the lesser of $7,000 or earned income ($8,000 or earned income if you are age 50 or older in 2024). Saving in a 401 (k) can come with unexpected tax bills.

Source: compassamg.com

Source: compassamg.com

"Backdoor" Roth IRAs What You Didn't Know Compass Asset Management, If your employer matched any of your yearly contributions, your mega. Saving in a 401 (k) can come with unexpected tax bills.

Mega Backdoor Roth Conversions—Which Permit Individuals To Convert As Much As $38,500 From Qualified 401 (K) Plans To A Roth Ira—Would Cease As Of January.

Here's what to check right away to avoid a surprise and 4 ways to reduce your taxes as you withdraw.

The Law Changes In 2023.

In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.