Medicare Part B Tax Brackets 2024 Over 65

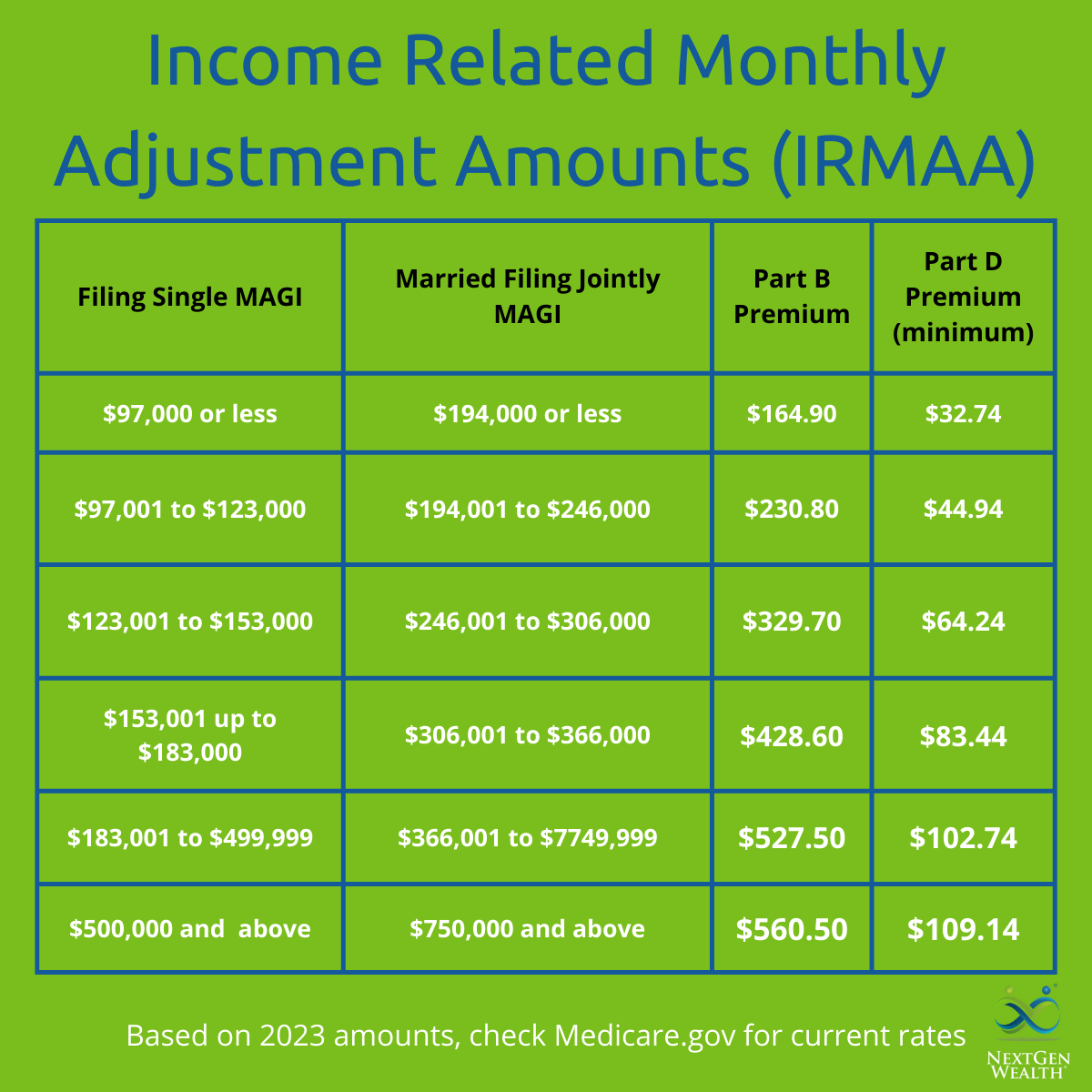

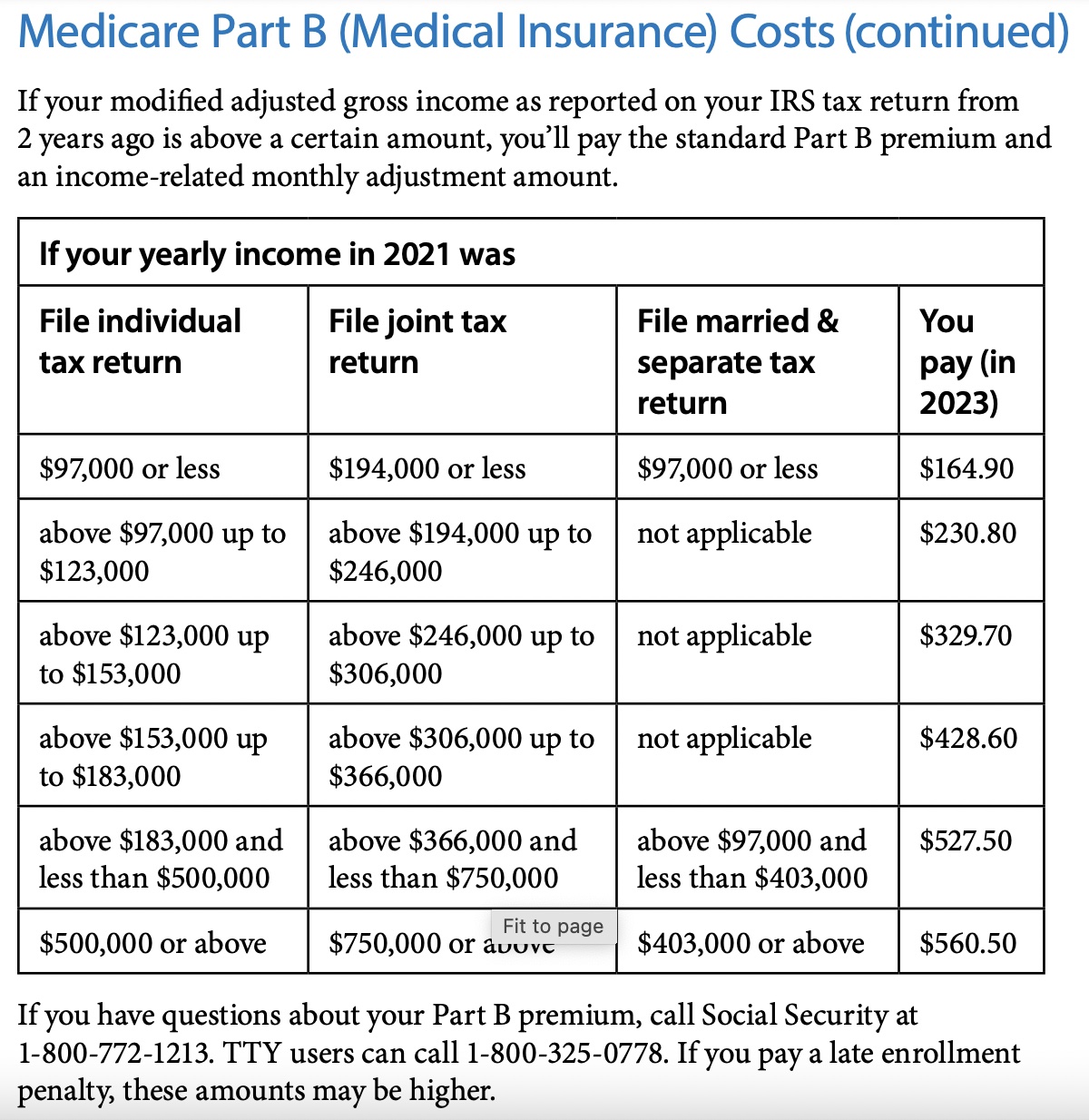

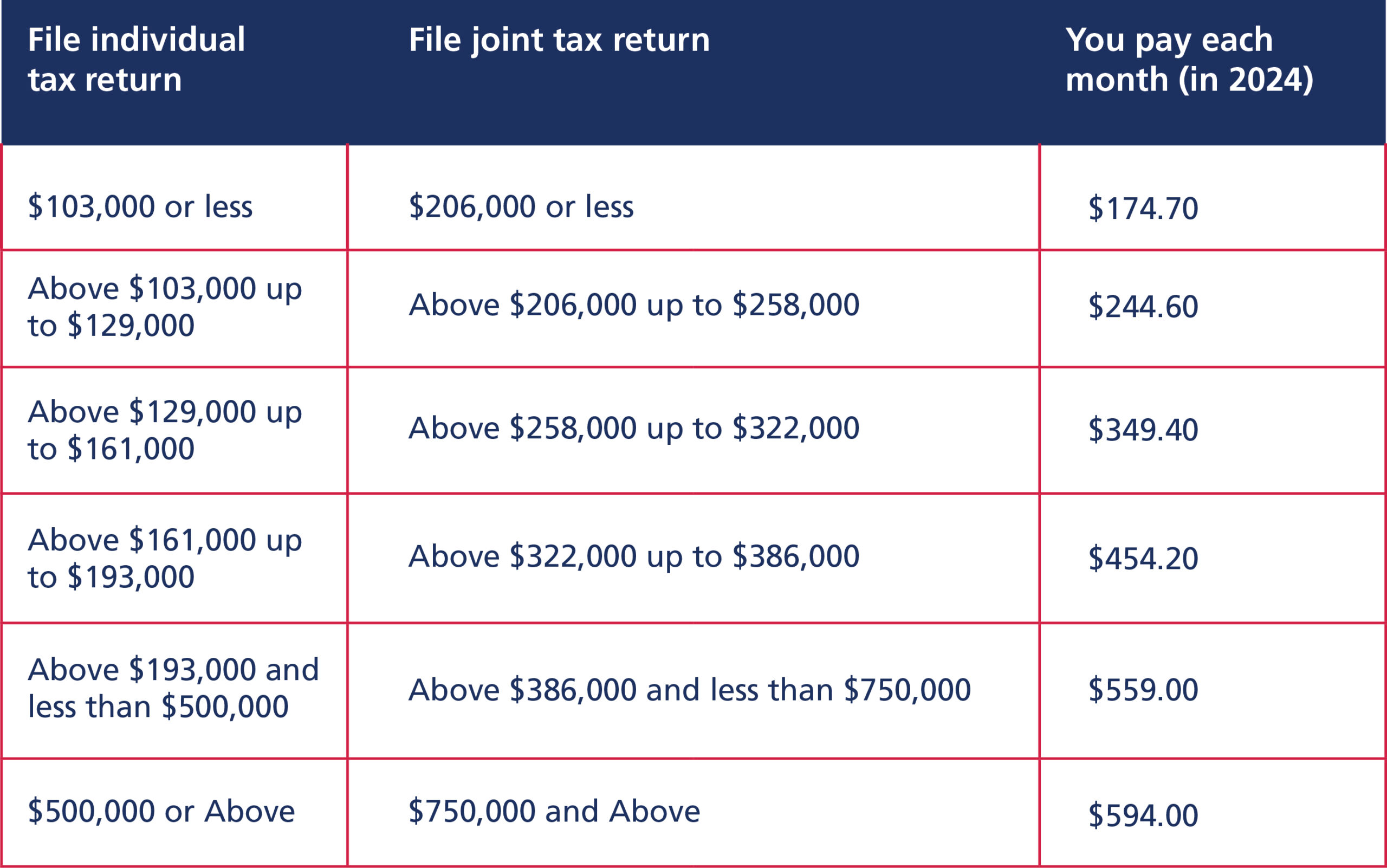

Medicare Part B Tax Brackets 2024 Over 65. Will your retirement income impact medicare surcharges? In 2024, if your 2022 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b.

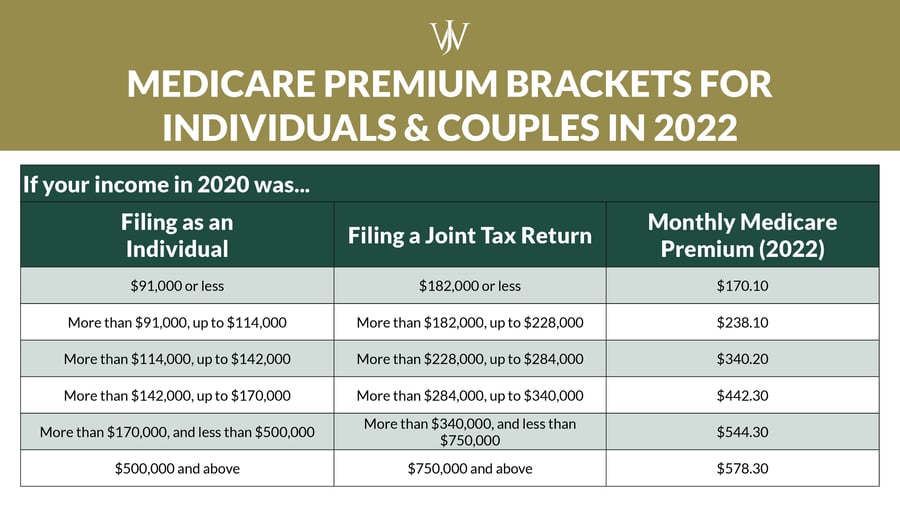

People with high incomes have a. Income brackets and surcharge amounts for part b and part d irmaa.

Medicare Part B Tax Brackets 2024 Over 65 Images References :

Source: marjiybernardina.pages.dev

Source: marjiybernardina.pages.dev

2024 Irmaa Brackets For Medicare Part B And D Claude Madelin, What you pay in 2024:

Source: louisettewtove.pages.dev

Source: louisettewtove.pages.dev

Medicare Tax Brackets 2024 Chart Corri Doralin, What you pay in 2024:

Source: gisellewdarla.pages.dev

Source: gisellewdarla.pages.dev

2024 Irmaa Brackets For Medicare Premiums Over 65 Maggi Beverlie, Retirees will pay more for medicare part b premiums in 2024.

Source: briayjerrie.pages.dev

Source: briayjerrie.pages.dev

Irmaa Brackets 2024 Medicare Tax Bekki Caressa, Irmaa is adjusted for inflation each year, so you could be in luck if you were slightly.

Source: ollieqrosabelle.pages.dev

Source: ollieqrosabelle.pages.dev

Standard Tax Deduction 2024 Over 65 Cele Meggie, In january 2024, most u.s.

Source: nertiyverina.pages.dev

Source: nertiyverina.pages.dev

2024 Irmaa Brackets For Medicare Benefits Quinn Carmelia, In 2024, if your 2022 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b.

Source: elianorawkarry.pages.dev

Source: elianorawkarry.pages.dev

Projected 2024 Irmaa Brackets Helge Kristy, This means that your medicare part b and part d premiums in 2024 may be based on your reported income in 2022.

Source: madelqpatience.pages.dev

Source: madelqpatience.pages.dev

Medicare Tax Rate 2024 Legra Natalee, This is the amount of income you have before other taxes and deductions have been made.

Source: hattyqiolanthe.pages.dev

Source: hattyqiolanthe.pages.dev

Medicare Brackets For 2024 Dayna Idaline, $174.70 if your annual income is below $103,000 ($206,000 for couples).

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

2024 IRMAA Brackets Medicare costs and Thresholds Healthcare, The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible.